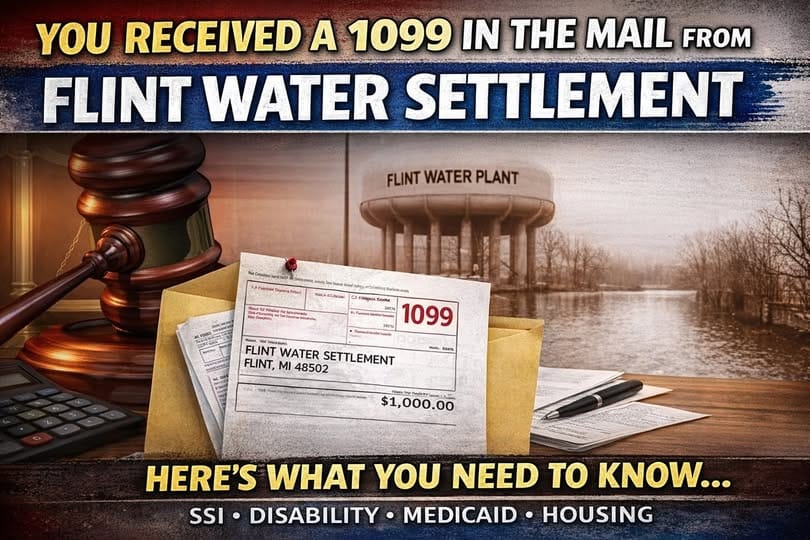

Flint Water Settlement 1099s Are Causing Confusion, Here’s What They Mean and Why the System Isn’t Fair to Low-Income Residents

Some Flint residents who received Flint water settlement property damage payments are now getting 1099 forms in the mail, and while this does not automatically mean the money is taxable or that anyone will lose benefits, it does mean the payment was reported to the federal government, which matters for people on income-based programs and highlights a larger issue with how the system treats poor and disabled residents.

Here is what people need to understand, without fear and without panic.

The property damage checks currently going out are averaging about $1,000. Those payments are being reported with a 1099 by the settlement payment administrator, not by the City of Flint. A 1099 simply tells the IRS that money was paid. It does not automatically mean taxes are owed. In many cases, property damage compensation is not taxable. The confusion comes from the reporting itself, not from an automatic tax bill.

Where this matters is for people who receive SSI, state disability, Medicaid tied to low income, housing assistance, or similar programs. These programs require income and assets to be reported. A one-time payment like this can show up in government systems even when it was meant to help someone recover from damage they did not cause.

This is not about saying people will lose benefits. Many will not. It is about understanding that the money is visible to the government and can affect paperwork, eligibility reviews, or how benefits are calculated depending on individual circumstances.

That brings up the larger problem.

Our system makes it extremely difficult for poor and disabled people to ever get ahead. You can receive assistance, but you are often not allowed to save. If you try to hold onto money to buy a reliable car, save for a housing down payment, replace furniture, fix a roof, or install a new furnace, you may be pressured to explain yourself or spend the money quickly just to stay within program rules. If you do not have credit, saving is often the only path forward, yet the system discourages saving at every turn.

That is not right.

People should be able to receive help and still build toward a better situation without hiding money or being forced to rush spending just to remain compliant. A settlement meant to compensate harm should not create new stress simply because someone is trying to be responsible.

This information is provided for informational purposes only and should not be considered legal or tax advice. Laws, benefit rules, and tax obligations depend on individual circumstances. Readers are encouraged to consult a qualified tax professional, benefits specialist, or attorney before making financial or reporting decisions.

The real question is why a system meant to help people survive makes it so hard for them to ever move forward?